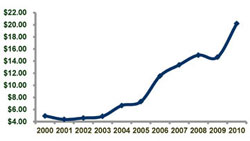

Prices

Silver is a commodity that is traded 24 hours a day in the world's market centers - London, Zurich, New York, Chicago and Hong Kong.

Silver is a commodity that is traded 24 hours a day in the world's market centers - London, Zurich, New York, Chicago and Hong Kong.

The London market started trading in the 17th century, and it - like other major markets - provides a vehicle for those who wish to trade in physical silver on a spot basis, or on a forward basis for hedging purposes.

The London market has a "fix" which offers the chance to buy or sell silver at a single price. The fix begins at 12:15 p.m. and is a balancing exercise; the price is fixed at the point at which all the members of the "Fixing" can balance their own, plus clients', buying and selling orders.

Although London remains the true center of the physical silver trade for most of the world, the most significant paper contracts trading market for silver in the United States is the COMEX division of the New York Mercantile Exchange. Spot prices for silver are determined by levels prevailing at the COMEX; and although there is no equivalent to the London fix, Handy & Harman, a precious metals company, also publishes a price at noon each working day.

A primary factor affecting the price of silver is the available supply versus fabrication demand. In recent years, fabrication demand has greatly outpaced mine production forcing market participants to draw down existing stocks to meet demand. As these available sources continue to decline, silver's fundamentals continue to strengthen. However, since silver is a tangible asset, and is recognized as a store of value, its price can also be affected by changes in things such as inflation (real or perceived), changing values of paper currencies, and fluctuations in deficits and interest rates, to name a few.

Silver recently traded at $37/Oz. (June 2011), having reached a high of almost $50 early in 2011. Many analysts predict that this trend will continue to go higher (TIS predicts near term $59/oz and $100 within 2 years).

World investment rose by an impressive 40 percent in 2010 to 279.3 million troy ounces (Moz), resulting in a net flow into silver of $5.6 billion, almost doubling 2009's figure.

Exchange traded funds (ETFs) registered another sterling performance in 2010, with global ETF holdings reaching an impressive 582.6 Moz, representing an increase of 114.9 Moz over the total in 2009. The iShares Silver Trust accounted for almost 40 percent of the increase, with other notable gains achieved by Zurcher Kantonalbank, ETF Securities, and the Sprott Physical Silver Trust.

A significant boost in retail silver investment demand paved the way for higher investment in both physical bullion bars and in coins and medals in 2010. Physical bullion bars accounted for 55.6 Moz of the world investment in 2010. Coins and medals fabrication rose by 28 percent to post a new record of 101.3 Moz. In the United States, over 34.6 million U.S. Silver Eagle coins were minted, smashing the previous record set in 2009 at almost 29 million. Other key silver bullion coins reaching milestones include the Australian Kookaburra, the Austrian Philharmoniker, and the Canadian Maple Leaf--all three posting record highs in 2010.

A significant boost in retail silver investment demand paved the way for higher investment in both physical bullion bars and in coins and medals in 2010. Physical bullion bars accounted for 55.6 Moz of the world investment in 2010. Coins and medals fabrication rose by 28 percent to post a new record of 101.3 Moz. In the United States, over 34.6 million U.S. Silver Eagle coins were minted, smashing the previous record set in 2009 at almost 29 million. Other key silver bullion coins reaching milestones include the Australian Kookaburra, the Austrian Philharmoniker, and the Canadian Maple Leaf--all three posting record highs in 2010.

Find out more about silver at the www.SilverInstitute.org